Discover Gold

Discover Gold Again

As Grandview Gold and other juniors pursue their 2011 exploration programs, many gold bugs and precious metals proponents believe the timing couldn't be better for qualified potential investors to consider gold as a portfolio fundamental. The run ups on gold have corrected and speculators have moved on. The present price environment is attracting the attention of the investment community and all indications are that, there remains plenty of room for movement.

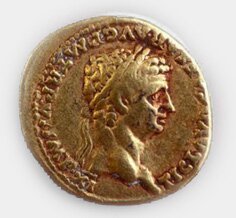

"The Desire for gold is the most universal and deeply rooted commercial instinct of the human race." ---- Gerald M. Loeb

Since time immemorial, deep thinkers and economists have considered the rise and fall of empires in relation to the rise and fall of gold. Today, with the economy and domestic and foreign geopolitical environments striving for equilibrium, some analysts are even predicting a return to the January 1980 environment equivalent of more than $2,500 USD per ounce in today's money (based on 1980 value of $850 USD oz Au). Some analysts of course take a more cautious view of gold's future. However, with gold hovering just under $1,800 USD those analysts focused on gold and precious metals markets remain bullish on the future of gold.

As a service to our subscribers, we post almost daily to this website. Click on the link provided or visit the section of the Media Centre. Sometimes controversial, but always interesting, the industry's most recognized newsmakers and analysts share their thoughts on the rise and fall of gold.

Gold Facts of Note:

- Historically, in rising gold markets, gold stocks tend to move farther and faster than bouillon.

- Interest rates and inflationary pressures are low by comparison.

- Increased global unrest encourages gold investment as a safe haven in troubled times.

- China is booming. The Chinese government recently de-regulated private ownership of and investment in gold, introducing 1.3 billion people to an already pressured gold market.

- India is thriving and with a population exceeding 1.1 billion, has the fastest-growing middle class in the world. Indians favor gold over other investments, including real estate.

- Diminished supply and increased demand for gold, particularly in jewelry sector (India leading the way)

- As real or perceived global chaos ensues, gold becomes attractive as a global currency.

- Since gold began free-trading, gold prices and the U.S. dollar have moved in opposite directions more than 80% of the time.

Since time began and through all economic and social conditions, mankind has pursued gold ownership with unequalled zeal. Borders have been re-drawn, history re-written, dynasties created and crumbled - all in the name of gold. To proponents, the motivation is clear and magnetic; gold is and will always be the standard against which all other investments are measured.

This Discover Gold section is provided as a courtesy to readers only and does not constitute an offering of services or securities. In all cases, interested parties should conduct their own investigation and analysis of Grandview Gold Inc and its assets and seek outside advice from a qualified investment, financial, legal, tax or accounting advisors.